Navigating FHA and VA Loans for Barndominiums: What You Need to Know

Barndominiums have become a popular housing option due to their versatility, affordability, and quicker construction times compared to traditional homes. However, financing a barndominium can be challenging, especially when it comes to securing loans through federal programs like those offered by the Federal Housing Administration (FHA) and the Veterans Affairs (VA). This article delves into the lending requirements for FHA and VA loans for barndominiums, offering insights into whether these loans are viable options for prospective builders and buyers.

Understanding FHA and VA Loans

**FHA Loans:**

FHA loans are designed to help low-to-moderate-income borrowers purchase homes by offering lower down payments and more flexible credit requirements than conventional loans. These loans are backed by the government, which reduces the risk for lenders.

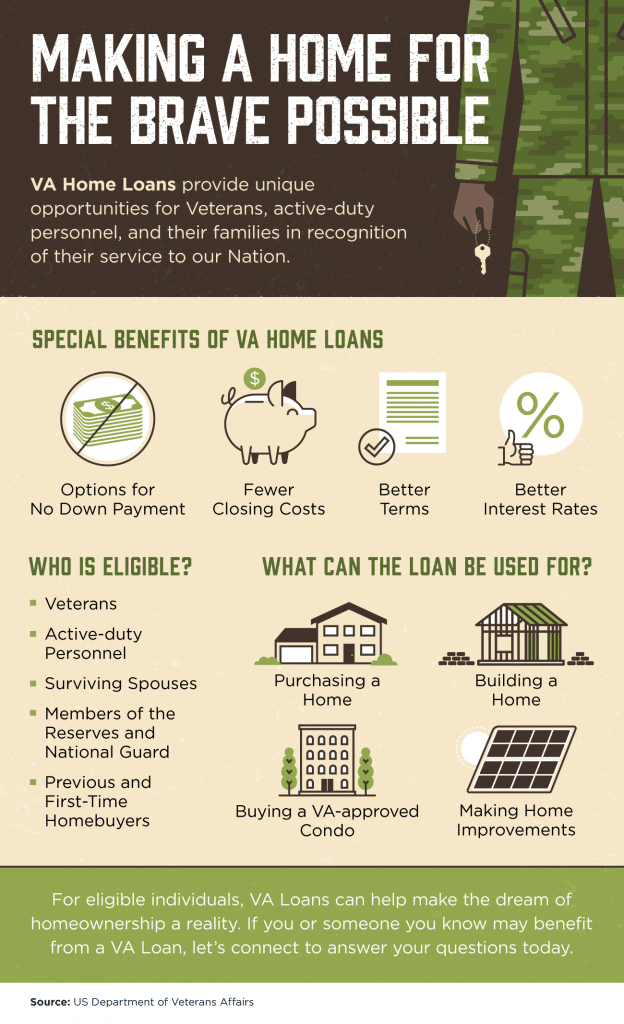

**VA Loans:**

VA loans provide significant benefits to veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans require no down payment, no private mortgage insurance, and offer competitive interest rates. Like FHA loans, VA loans are also government-backed.

FHA Loans for Barndominiums

Getting an FHA loan for a barndominium can be complicated. The primary hurdle is that FHA loans require the property to meet certain safety, security, and soundness standards. Since barndominiums often start as agricultural or commercial buildings before conversion, meeting these residential standards can be challenging.

**Key Requirements:**

1. **Property Standards:** The barndominium must comply with FHA’s Minimum Property Standards, which ensure the property is safe, sound, and secure.

2. **Primary Residence:** FHA loans are only available for primary residences, so the barndominium must be the borrower’s primary place of living.

3. **Appraisal:** An FHA-approved appraiser must inspect the property to ensure it meets HUD’s standards for health and safety.

Because of these requirements, whether an FHA loan can be used for a barndominium largely depends on the specifics of the building and its conformity to residential standards.

VA Loans for Barndominiums

VA loans also have stringent requirements that can make securing one for a barndominium challenging. Like with FHA loans, the property must be intended for residential use, meet certain construction and safety standards, and pass an inspection by a VA-approved appraiser.

**Key Requirements:**

1. **Certificate of Eligibility:** The borrower must have a valid Certificate of Eligibility proving their entitlement to VA benefits.

2. **Primary Residence:** The borrower must intend to occupy the property as their primary residence.

3. **Construction Standards:** The property must meet local building codes and VA’s Minimum Property Requirements for safety and habitability.

Barndominiums can qualify for a VA loan if they meet these criteria and are essentially indistinguishable from other residential properties in terms of amenities and safety features.

Solutions and Recommendations

**1. Working with Experienced Builders:**

Partner with builders who have experience in constructing barndominiums that meet FHA and VA standards. These builders can ensure the construction complies with the necessary requirements from the start.

**2. Detailed Planning and Documentation:**

Provide detailed plans and documentation during the loan application process to demonstrate that the barndominium meets all eligibility criteria. This includes floor plans, a list of materials used, compliance with local building codes, and any other relevant documentation.

**3. Pre-Approval and Appraisals:**

Before starting construction, get pre-approval from an FHA or VA lender and ensure an approved appraiser is involved early in the process to advise on any potential issues that could affect loan approval.

While obtaining FHA or VA loans for barndominiums can be more challenging than for traditional homes, it is not impossible. The key is to ensure that the property meets all regulatory and safety standards required by these programs. By carefully planning your project and working with experienced professionals, you can increase your chances of securing an FHA or VA loan for your barndominium, making your dream home more attainable.