Exploring VA Loan Requirements for Barndominium Builds**

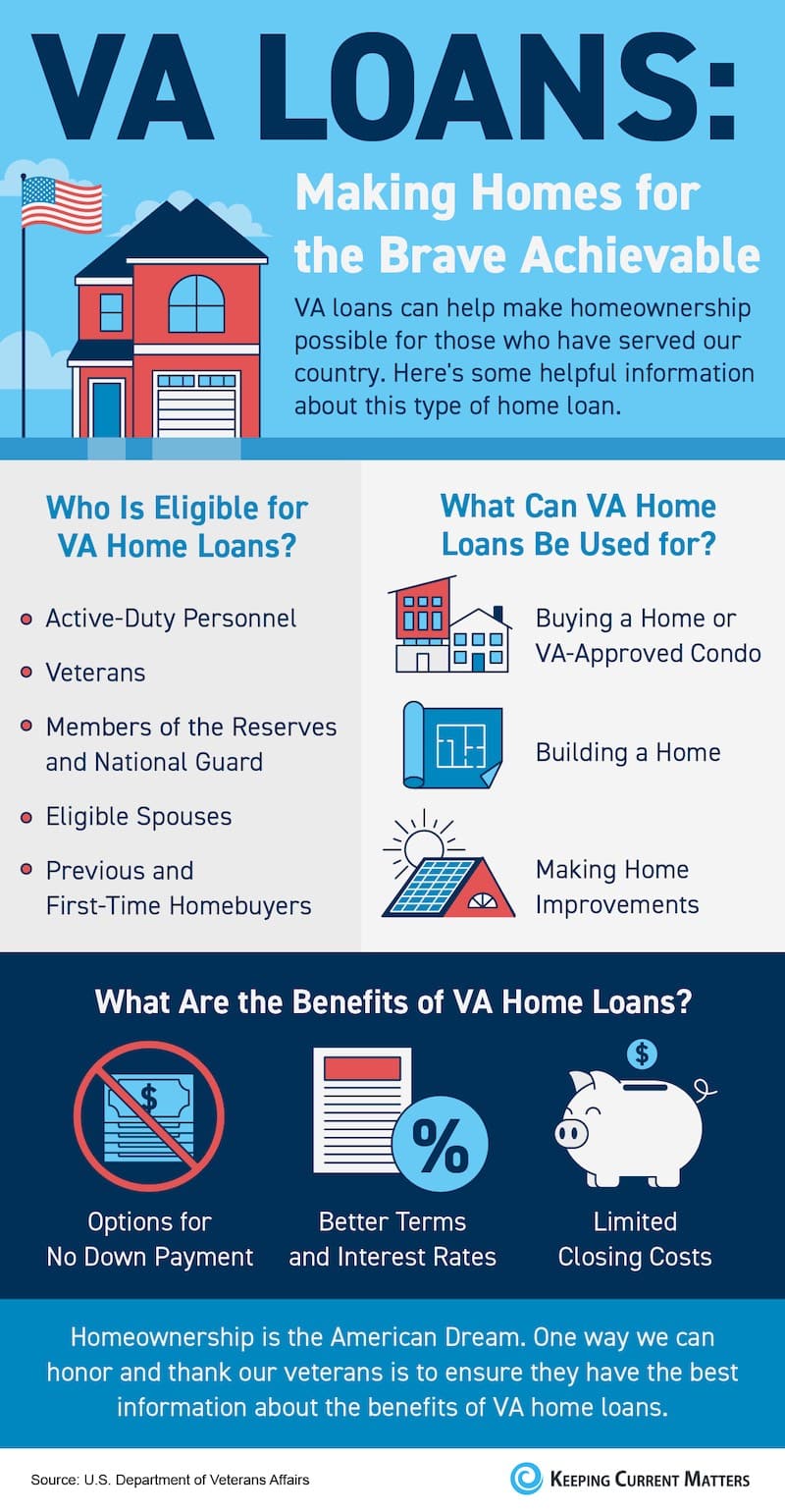

For veterans and service members looking to purchase or build a unique home, the barndominium is an attractive, modern option. But when it comes to financing, many veterans wonder if they can use a VA loan to build a barndominium. While VA loans are known for their excellent benefits and flexible terms, they come with specific requirements for eligible properties. Let’s take a look at whether a barndominium qualifies for a VA loan, what the requirements are, and how a VA loan compares to conventional loans.

Does the VA Fund Barndominiums?

The U.S. Department of Veterans Affairs (VA) does allow its loans to be used to finance certain types of properties, including some barndominiums. However, there are a few key requirements a barndominium must meet to qualify for VA financing:

1. **The Property Must Serve as the Primary Residence**

VA loans are intended for homes that serve as primary residences for the borrower, which means the barndominium must meet all requirements for primary residential use. Vacation homes, investment properties, or structures not intended for year-round living won’t qualify.

2. **The Property Must Meet VA Minimum Property Requirements (MPRs)**

VA loans come with minimum property standards to ensure that the home is safe, structurally sound, and livable. For barndominiums, this means that the property must include basic amenities like a functional kitchen, bathroom, and living space. The structure should also have adequate heating, cooling, and water supply. Meeting these standards can be more challenging if the barndominium is initially designed as a shell, but with the right finishes and floor plan, most barndominiums can meet VA MPRs.

3. **The Property Must Be Permanently Attached to a Foundation**

Unlike some modular or mobile homes, the VA requires that a financed property, including barndominiums, is permanently affixed to a foundation. This ensures the property’s stability and makes it easier for the VA to assess its long-term value. Additionally, the structure must comply with all local building codes and zoning laws.

4. **The Builder Must Be VA-Approved**

When using a VA loan to build a barndominium, the construction process must be completed by a VA-approved builder. This means you’ll need to verify that your builder has been certified by the VA to ensure they meet the agency’s standards for quality and accountability. If your preferred builder isn’t yet VA-approved, they can apply for approval through the VA’s builder registration process.

Steps to Build a Barndominium with a VA Loan

1. **Get Pre-Approved for a VA Loan**

Before starting construction, get pre-approved by a VA lender to understand your budget. This process includes verifying your military service eligibility and financial qualification.

2. **Choose a VA-Approved Builder**

Select a builder who meets VA certification requirements and has experience with barndominium construction. The builder will need to work with the lender to provide construction plans and ensure all project specifications align with VA MPRs.

3. **Secure Construction-to-Permanent Financing**

Many VA loans are structured as construction-to-permanent loans, meaning you receive funds during construction, and the loan transitions to a mortgage once the barndominium is complete. During construction, the lender will likely disburse funds in stages to ensure each phase meets requirements and is on schedule.

4. **Undergo Inspections and Appraisal**

Once construction is complete, the VA requires an inspection and appraisal to confirm the property meets all standards. At this stage, the lender verifies that the home is ready for occupancy, all MPRs have been met, and the barndominium’s appraised value aligns with the loan amount.

Benefits of a VA Loan Versus a Conventional Loan

While a conventional loan can be used to build a barndominium, a VA loan offers several distinct advantages:

1. **No Down Payment**

One of the biggest benefits of a VA loan is that qualified borrowers can finance a home with no down payment. Conventional loans generally require a down payment of at least 3-5%, and that can be a significant sum for a new construction project. Eliminating the need for a down payment makes homeownership more accessible for veterans, especially for unique builds like barndominiums.

2. **Lower Interest Rates**

VA loans often have lower interest rates than conventional loans, saving borrowers significant money over time. This is particularly beneficial for barndominium owners, who may have unique customization costs, allowing them to allocate more of their budget toward building the home they want.

3. **No Private Mortgage Insurance (PMI)**

Unlike conventional loans, VA loans do not require PMI, which is typically necessary if the down payment is less than 20%. PMI can add hundreds of dollars a month to a mortgage payment, so not having this cost is a huge advantage of VA financing, freeing up more funds for construction expenses.

4. **More Lenient Credit Requirements**

VA loans have more flexible credit requirements than conventional loans, allowing veterans with less-than-perfect credit scores to qualify for a home loan. This leniency makes VA loans a better option for veterans who may be rebuilding credit or who have unique financial situations.

5. **Easier Refinancing Options**

The VA also offers streamlined refinancing options, such as the VA Interest Rate Reduction Refinance Loan (IRRRL), which allows borrowers to refinance at a lower rate with minimal paperwork. This flexibility provides a valuable fallback if interest rates drop, helping veterans manage their home expenses efficiently.

Is a Barndominium the Right Choice for You?

If you’re a veteran or active-duty service member interested in a barndominium, using a VA loan to fund the construction can provide you with substantial savings and flexibility. While building a barndominium with a VA loan requires meeting specific property standards, the benefits of VA financing—such as no down payment, low interest rates, and no PMI—make it an attractive option for veterans.

As barndominiums continue to rise in popularity, more builders are adapting to VA requirements, making it easier than ever for veterans to build their dream homes in unique styles that combine affordability, durability, and modern appeal. By meeting VA standards and working with a VA-approved builder, veterans can take advantage of the many benefits VA loans offer and enjoy a custom-built barndominium that meets their needs and reflects their style.