Financing a Barndominium in Alabama: Options and Approval Tips

Building a barndominium in Alabama presents unique opportunities and challenges, especially when it comes to financing. Unlike traditional homes, barndominiums often require specialized lending solutions due to their unique structure and dual-purpose design. This comprehensive guide explores the financing options available to Alabama residents looking to build a barndominium, along with essential tips for getting approved by lenders.

Understanding Barndominium Financing

Barndominiums are a hybrid Structure between barns and condominiums, typically featuring a combination of living quarters and workshop or garage space and called by a handful of names, Pole barn house, S-House, Shop House just to name a few. Financing such buildings can be complex because they don’t always fit neatly into conventional residential or commercial property categories. Rural and local Building Departments sometimes need to be educated on What a barndominium is, In some jurisdictions, you may have to take your Floor Plans in for the building department to approve on a build by build basis.

Key Challenges in Financing Barndominiums:

1. **Appraisal Issues**: Barndominiums can be challenging to appraise due to their unique nature and lack of comparable sales.

2. **Loan Classification**: Depending on its primary use, a barndominium can be classified either as residential or commercial, affecting the type of loan you might qualify for.

3. **Insurance and Compliance**: Ensuring that the construction complies with local building codes and finding suitable insurance can affect loan approval.

Financing Options in Alabama

Conventional Mortgages

– **Description**: Traditional home loans offered by banks, credit unions, and mortgage brokers that conform to the standards set by Fannie Mae and Freddie Mac.

– **Suitability**: Best for barndominiums intended primarily for residential use.

– **Challenges**: May require detailed documentation proving that the property will be used as a residence.

Construction Loans

– **Description**: Loans designed for the construction phase, which are converted into a regular mortgage upon completion.

– **Suitability**: Ideal for those building a barndominium from scratch.

– **Providers in Alabama**: Many local banks and credit unions offer construction loans that can be tailored for barndominium projects.

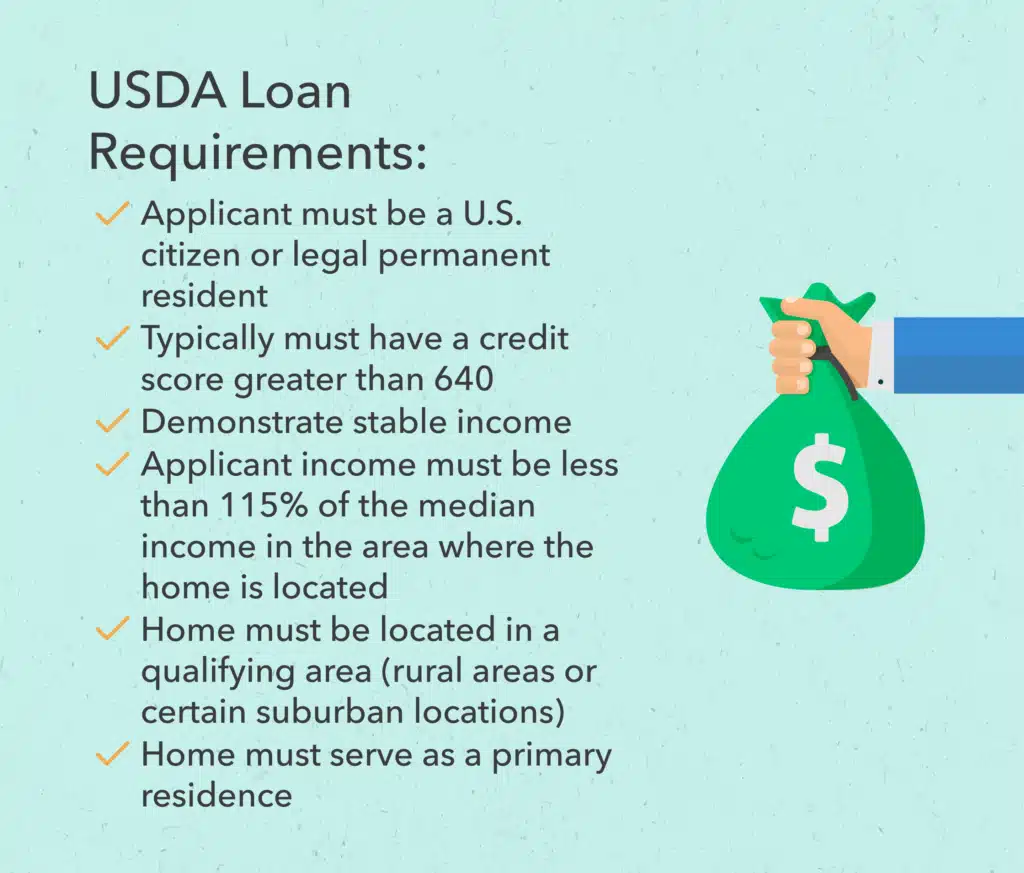

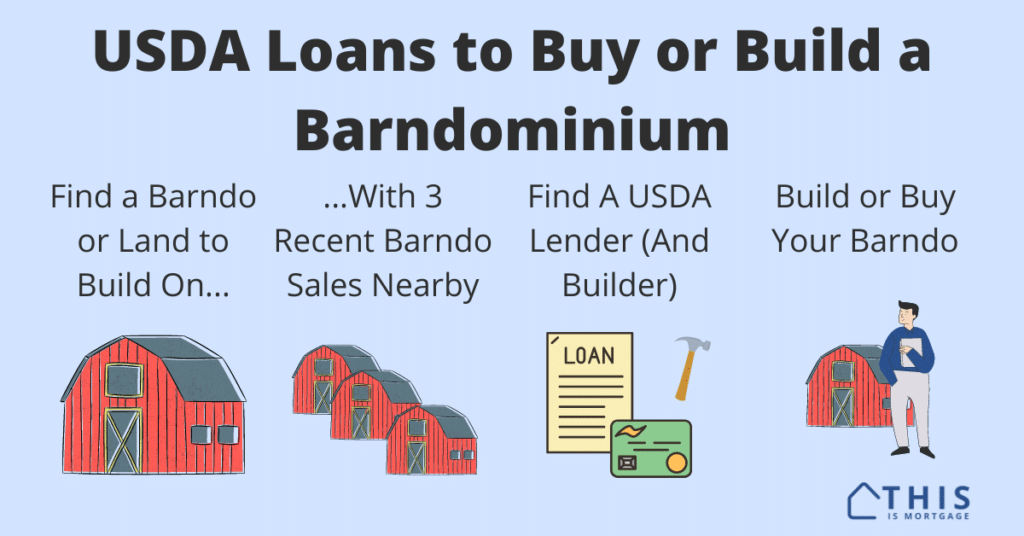

USDA Rural Development Loans

– **Description**: Government-backed loans that offer zero down payment options for homes in eligible rural areas.

– **Suitability**: Best for barndominiums located in rural parts of Alabama, as defined by the USDA.

– **Benefits**: Competitive interest rates and no down payment requirement.

FHA Loans

– **Description**: Loans backed by the Federal Housing Administration, featuring low down payments and flexible credit requirements.

– **Suitability**: Can be used for barndominiums if they meet certain energy efficiency and structural standards.

– **Requirements**: The property must be the borrower’s primary residence.

Specialty Lenders

– **Description**: Some lenders specialize in non-traditional properties, including barndominiums.

– **Options in Alabama**: Companies like Barndo Loans or Texas Barndominium Financing often extend their services to Alabama, offering customized financing solutions.

Tips for Getting Approved Faster

1. **Prepare Detailed Documentation**

– Provide detailed blueprints and a comprehensive plan for the use of the property.

– Include estimates from contractors and a timeline for construction.

2. **Boost Your Credit Score**

– Ensure your credit history is in good shape. A higher credit score can increase your chances of loan approval and secure better interest rates.

3. **Provide a Sizable Down Payment**

– Although some loan options offer low or no down payment, providing a larger down payment can improve your loan terms and demonstrate financial commitment to the lender.

4. **Appraisal and Inspection**

– Hire a professional appraiser familiar with barndominiums.

– An appraisal that favorably compares your planned barndominium to similar properties can significantly aid in securing financing.

5. **Seek Professional Advice**

– Consult with mortgage brokers or financial advisors who have experience with barndominium financing. They can provide insights and help navigate the lending landscape. Don’t be shy or afraid to step out and ask for assistance, banks like to help any way they can it’s advantageous for both parties.

Financing a barndominium in Alabama requires careful preparation and an understanding of the specific challenges associated with this type of property. By exploring various loan options and preparing your application thoroughly, you can increase your chances of getting a favorable loan to bring your barndominium project to life by visiting Buildmax.com for a catalog of Barndominium Floor Plans With Steel frame barndominium kits to match. As a parting tip, Always Remember, each lending situation is unique, so it’s important to discuss your specific needs with a financial advisor or a lender who understands the intricacies of barndominium financing if it’s not something you fully grasp yourself. Don’t be afraid to lean on others for advice and understanding.