Can You Get a 30-Year Mortgage on a Barndominium?

As barndominiums become more popular across the United States, many prospective homeowners wonder whether they can secure a **30-year mortgage** on a barndominium, just as they would with a traditional home. The short answer is: **yes**, it is possible to get a 30-year mortgage on a barndominium, but there are specific factors to consider. In this article, we’ll explore the key factors that affect mortgage approval for barndominiums, including lender considerations, the type of construction (steel frame vs. wood frame), and tips on how to improve your chances of securing financing.

Barndominiums and Traditional Mortgages

A **30-year mortgage** is the most common loan term for traditional homes, offering lower monthly payments spread out over three decades. When it comes to barndominiums, the process of securing a mortgage is similar to that for a traditional house, but there are some challenges that can arise due to the unique nature of these homes. Understanding these challenges can help you better navigate the financing process.

1. **Lender Familiarity With Barndominiums**

The main challenge in securing a 30-year mortgage on a barndominium is finding a lender that is **familiar with barndominiums**. Since barndominiums are a relatively new concept in some areas, not all lenders understand their value or structure. Lenders tend to feel more comfortable with traditional homes, which can make them hesitant about financing non-standard housing, such as barndominiums.

However, as barndominiums grow in popularity, especially in states like Texas, Ohio, and throughout the Midwest and South, more lenders are becoming knowledgeable about these homes. Many lenders now realize that barndominiums, particularly **steel-framed** ones, are durable, long-lasting, and valuable investments. In rural areas where barndominiums are common, it may be easier to find a lender who understands their appeal and value.

2. **Appraisal Challenges**

One key factor in securing a 30-year mortgage for a barndominium is the **appraisal process**. Lenders require an appraisal to ensure that the value of the home aligns with the amount of money being borrowed. For traditional homes, appraisers use **comparable sales (comps)** to estimate the home’s value based on recent sales of similar properties in the area.

The challenge with barndominiums is that in some areas, especially where they are not yet widespread, there may be **fewer comparable properties** to use in the appraisal. Without a reliable set of comps, the appraiser may struggle to accurately determine the value of the barndominium, which can lead to difficulties in securing a mortgage or receiving the desired loan amount.

3. **Construction Type: Steel Frame vs. Wood Frame**

Another factor that can influence mortgage approval is the **type of construction** used in the barndominium. Barndominiums can be built with either **steel frames** or **wood frames**, and lenders may view these two construction types differently.

– **Steel Frame Barndominiums**: Steel frame homes are known for their durability, resistance to pests, and ability to withstand extreme weather conditions. Many lenders view steel-framed homes as a valuable, long-lasting investment, which can make it easier to secure a 30-year mortgage. However, in some areas, lenders may still be hesitant to finance non-traditional homes like barndominiums, even if they are steel-framed.

– **Wood Frame Barndominiums**: Wood frame barndominiums are more similar to traditional homes in terms of construction, which may make some lenders more comfortable with financing them. However, wood is more susceptible to pests, rot, and other issues, which could make these homes riskier in the eyes of some lenders.

In both cases, the **quality of construction** and adherence to local building codes will play a significant role in the mortgage approval process.

How to Get a 30-Year Mortgage on a Barndominium

If you’re looking to finance a barndominium with a 30-year mortgage, there are steps you can take to improve your chances of securing approval:

1. **Work With a Lender Familiar With Barndominiums**

One of the most important steps in the process is finding a **lender who is familiar with barndominiums**. Lenders in rural areas or regions where barndominiums are common are more likely to have experience financing these types of homes. Some lenders even specialize in financing non-traditional homes, including barndominiums.

– **Farm Credit Services** and local rural banks may be more open to financing barndominiums because they often deal with homes and properties that fall outside the scope of traditional housing.

2. **Provide Detailed Plans and Documentation**

When applying for a mortgage on a barndominium, it’s important to provide **detailed documentation** about the construction and design of the home. This can help alleviate lender concerns by showing that the barndominium is being built to high standards.

– Include **blueprints**, **construction plans**, and a breakdown of the **materials** being used (steel frame, insulation, etc.). This will give the lender a clearer idea of the quality and longevity of the home.

– If you’re working with a well-knowBuilder or barndominium supplier, make sure to provide information about their reputation and experience.

3. **Ensure Proper Appraisal**

To avoid issues during the appraisal process, it’s important to work with an appraiser who is familiar with barndominiums and understands how to value them. An experienced appraiser will know what factors to look for, such as the type of construction, square footage, and location.

– **Comparable Sales**: If there are other barndominiums in the area, make sure the appraiser is aware of them so they can be used as comps. If there are no nearby barndominiums, the appraiser may need to rely on custom-built homes or other non-traditional properties for comparisons.

4. **Check Zoning and Building Codes**

Before you build a barndominium, make sure the property complies with **local zoning laws** and **building codes**. Some areas may have restrictions on building non-traditional homes or homes with mixed-use spaces (like combining living areas with workshops or barns). Ensuring compliance will help avoid issues during the financing process.

5. **Consider a Construction Loan First**

If you’re building a new barndominium, consider securing a **construction loan** first. Construction loans are typically short-term loans that cover the cost of building the home. Once the home is completed and meets all building codes and requirements, the construction loan can be converted into a **30-year mortgage**.

– Construction loans typically come with higher interest rates and shorter terms (6-12 months) during the building phase, but once the barndominium is complete, the loan can be converted into a more traditional mortgage with lower interest rates and longer repayment terms.

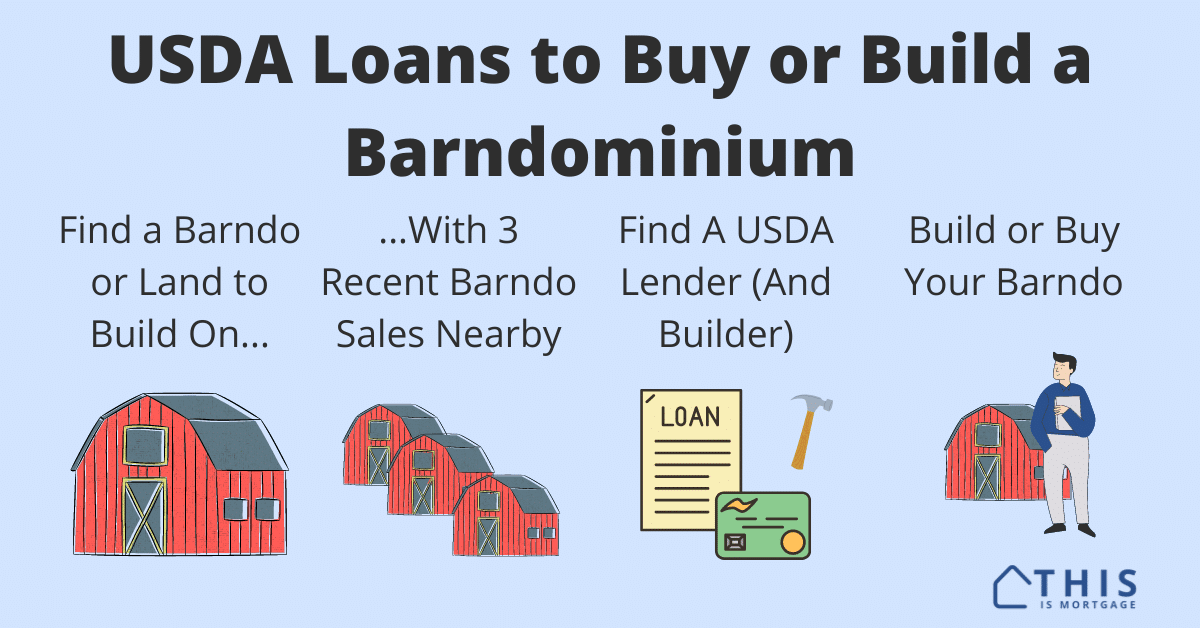

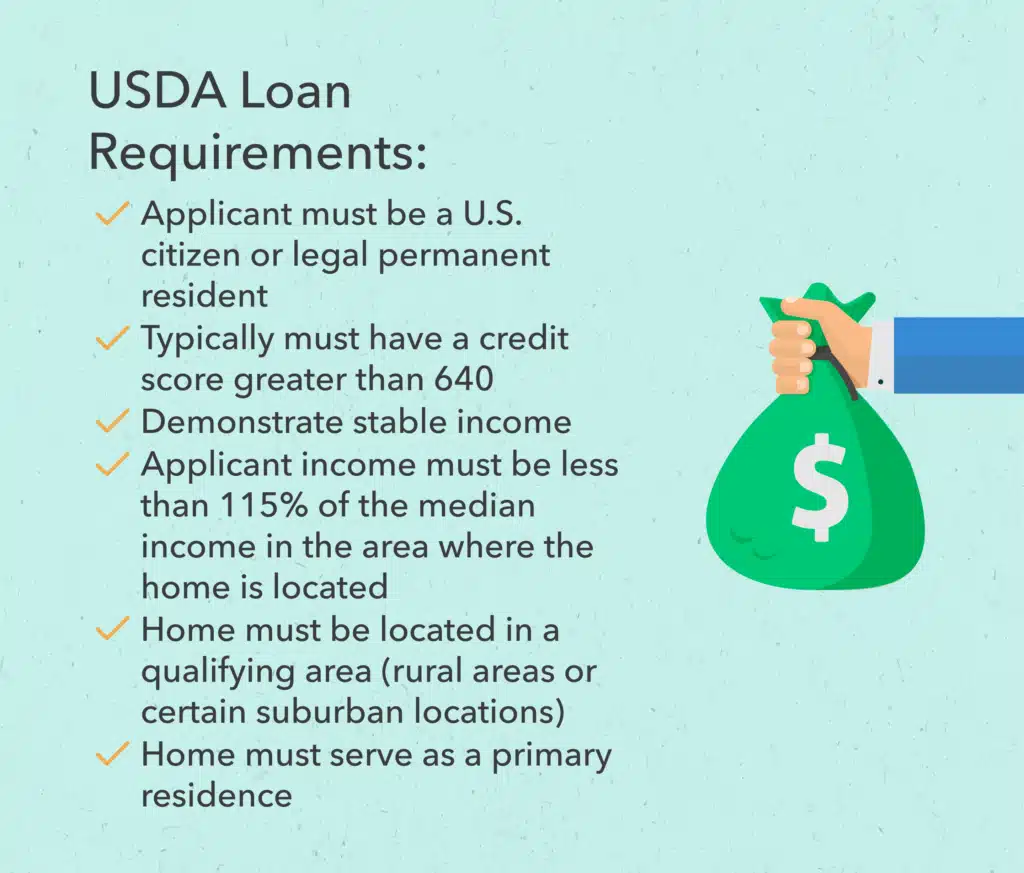

Can You Use USDA or VA Loans for a Barndominium?

For those looking to finance a barndominium in rural areas, **USDA loans** may be an option. The U.S. Department of Agriculture (USDA) offers loans for homes in qualifying rural areas, and barndominiums may be eligible if they meet the USDA’s guidelines for residential properties.

– **USDA Loans**: These loans come with favorable terms, such as zero down payment, but the barndominium must be a primary residence and meet specific livability requirements.

– **VA Loans**: If you’re a veteran, you may be able to use a **VA loan** to finance a barndominium, as long as it meets the VA’s housing standards. VA loans also offer favorable terms, such as zero down payment and competitive interest rates.

Conclusion: Yes, You Can Get a 30-Year Mortgage on a Barndominium

In summary, it is absolutely possible to get a **30-year mortgage** on a barndominium, but there are unique challenges to consider. The key is finding a lender who understands the value of barndominiums, particularly **steel frame structures**, and providing detailed documentation about the construction quality and plans. By working with an experienced lender and ensuring that the barndominium meets local building codes and appraisal requirements, you can secure financing for your dream home and enjoy the benefits of a 30-year mortgage, just as you would with a traditional house.