Is it Hard to Get a Mortgage for a Barndominium?

Barndominiums have gained popularity for their unique aesthetic and practical benefits. However, securing a mortgage for a barndominium can present some challenges. Here’s a detailed look at why this may be the case and some possible solutions.

Challenges in Securing a Barndominium Mortgage

1. **Non-Traditional Structure**

Barndominiums are unconventional compared to traditional homes, which can make lenders cautious. Lenders are often more comfortable with standard residential properties because they have established market values and resale potentials.

2. **Appraisal Difficulties**

One significant hurdle is the appraisal process. Barndominiums can be challenging to appraise due to the lack of comparable properties (comps). Without sufficient comps, appraisers may struggle to determine the accurate market value of a barndominium, making lenders hesitant.

3. **Zoning and Building Codes**

Barndominiums might face issues related to zoning laws and building codes, which vary significantly by location. In areas where barndominiums are less common, there may be stricter regulations or a lack of clear guidelines, adding another layer of complexity for lenders.

4. **Perceived Marketability**

Lenders may perceive barndominiums as less marketable than traditional homes, especially in areas where they are not common. This perceived risk can make it harder to get a favorable mortgage rate or approval.

5. **Insurance Complications**

Obtaining insurance for a barndominium can be more complex, which in turn affects the mortgage process. Some insurance companies may not offer standard policies for these types of structures, leading to higher premiums or specialized coverage requirements.

Possible Solutions

1. **Specialized Lenders**

Seek out lenders who specialize in non-traditional properties. Some lenders have experience with barndominiums and are more willing to work with borrowers to navigate the unique challenges.

2. **Construction Loans**

Consider starting with a construction loan. These loans can be converted into a mortgage once the construction is complete and the property has been appraised. This approach can sometimes mitigate the initial appraisal and zoning challenges.

3. **Higher Down Payment**

Offering a higher down payment can reduce the lender’s risk and potentially make them more willing to approve a mortgage. This shows financial commitment and can offset some of the perceived risks associated with a non-traditional property.

4. **Work with an Experienced Realtor and Builder**

Engage professionals who have experience with barndominiums. An experienced realtor can help find comps and a knowledgeable builder can ensure the construction meets local codes and regulations, facilitating smoother appraisals and approvals.

5. **Comprehensive Appraisal**

Opt for a detailed and comprehensive appraisal. Providing extensive documentation about the property, including construction costs, features, and potential resale value, can help appraisers make a more accurate assessment.

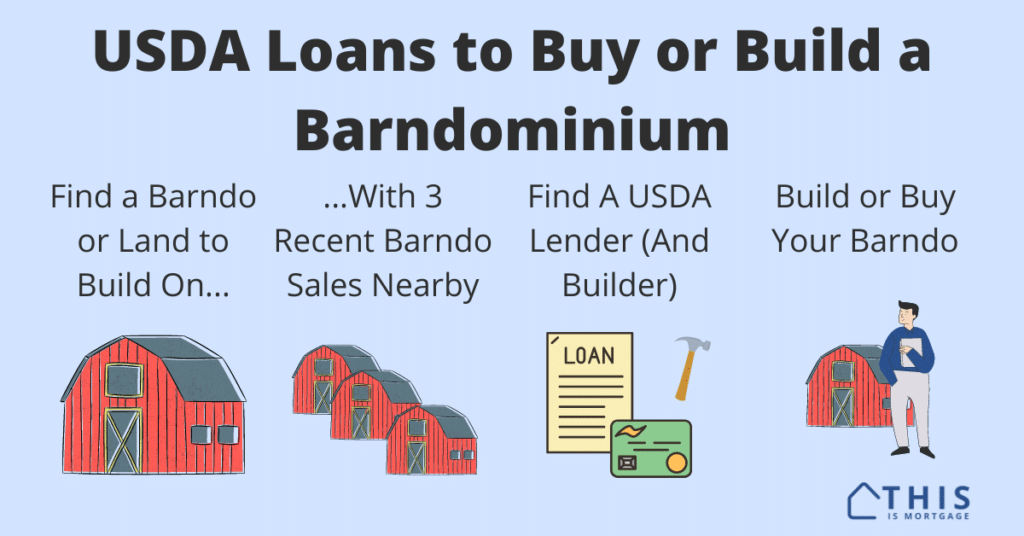

6. **Flexibility in Loan Type**

Explore different types of loans. For instance, USDA loans for rural properties or VA loans for veterans might have more flexible terms for non-traditional homes. Researching various loan options can reveal more opportunities.

7. **Improving Marketability**

To address concerns about marketability, consider features that enhance the property’s appeal, such as modern amenities and energy-efficient installations. Ensuring the property is attractive to a broader market can alleviate lender concerns.

All-in-All

While getting a mortgage for a barndominium can be more challenging than for a traditional home, it is not impossible. By understanding the unique hurdles and exploring tailored solutions, prospective barndominium owners can improve their chances of securing financing. Specialized lenders, higher down payments, and working with experienced professionals can make the process smoother and more successful.