Why Can’t You Finance a Barndominium? (And How You Actually Can)

One of the common misconceptions about barndominiums is that they can’t be financed like traditional homes. While it’s true that financing a barndominium can sometimes be more challenging than securing a mortgage for a standard home, it’s not impossible. In fact, with the growing popularity of barndominiums and their increasing presence in the real estate market, more lenders are becoming familiar with this type of construction and offering financing options. In this article, we’ll explore why financing a barndominium can be difficult and how you can still obtain financing to build or purchase your dream barndominium.

Why Is Financing a Barndominium More Challenging?

The challenge of financing a barndominium primarily stems from how they are viewed by traditional mortgage lenders. Because barndominiums often don’t fit the conventional mold of what lenders consider “standard” residential properties, they can be seen as riskier investments. Here are a few of the key reasons why financing can be more difficult:

1. **Non-Traditional Construction**

Many barndominiums are built using **steel frames** or other unconventional materials, which can make lenders hesitant. Traditional homes are often wood-framed, which is what most lenders are used to underwriting. Barndominiums, which combine living spaces with barn-like structures or workshops, might not be viewed in the same way, especially if part of the structure is designated for non-residential use.

– **Lender Concerns**: Lenders may worry that if they need to foreclose on the property, it may be harder to resell a non-traditional home like a barndominium compared to a standard house. This perceived risk can make them more cautious about approving loans for barndominiums.

2. **Appraisal Challenges**

A significant obstacle in financing a barndominium is the **appraisal process**. Lenders typically require a home appraisal to determine the value of the property before they approve a mortgage. However, because barndominiums are still relatively new in many markets, there may be fewer comparable properties (also known as “comps”) to use in the appraisal. This can result in appraisal issues, where the barndominium is valued lower than expected, making it harder to secure a loan.

– **Fewer Comps**: In some rural areas where barndominiums are popular, finding enough comparable sales can be difficult, which may cause the appraiser to assign a lower value to the property. Lenders rely heavily on appraisals when determining loan amounts, so this can create financing hurdles.

3. **Mixed-Use Concerns**

Barndominiums are often used as **mixed-use structures**, combining living space with workshops, garages, or even farming spaces. Some lenders view these properties as more commercial in nature, which might place them outside the standard residential lending criteria. This can create issues if the lender doesn’t specialize in financing mixed-use properties.

– **Zoning and Purpose**: Lenders may ask questions about the zoning of the property and how the space will be used. If part of the barndominium is set aside for business or agriculture, the lender might classify the loan differently, adding complexity to the financing process.

How You Can Finance a Barndominium

Despite these challenges, it’s absolutely possible to finance a barndominium. More lenders are recognizing the demand for these unique homes, and there are several ways you can approach financing to overcome the initial obstacles. Here are some financing options that can help you secure the funds for your barndominium:

1. **Construction Loans**

Many people finance the construction of a barndominium with a **construction loan**, which is specifically designed for new builds. Construction loans are typically short-term loans that cover the cost of the building process, and they are usually converted into a traditional mortgage once the home is completed.

– **How It Works**: With a construction loan, the lender disburses funds in stages as the construction progresses. Once the barndominium is finished and has a certificate of occupancy, the loan is then rolled into a standard mortgage. This type of loan works well for barndominiums, especially when building from scratch.

– **Down Payment**: Construction loans typically require a larger down payment, often between 20% and 30% of the total cost of the project.

2. **Barndominium-Friendly Lenders**

As barndominiums become more popular, some lenders specialize in financing them. These lenders are more familiar with the unique aspects of barndominium construction and appraisal, making them more willing to work with you. Companies that specialize in rural or agricultural loans, such as **Farm Credit Services**, are often more open to financing barndominiums.

– **Local and Regional Banks**: Smaller, local lenders or credit unions, especially in rural areas where barndominiums are more common, may be more willing to provide financing compared to large national banks.

– **Specialized Lenders**: Some lenders specialize in **non-traditional or mixed-use properties**, and they may offer flexible loan options for barndominiums.

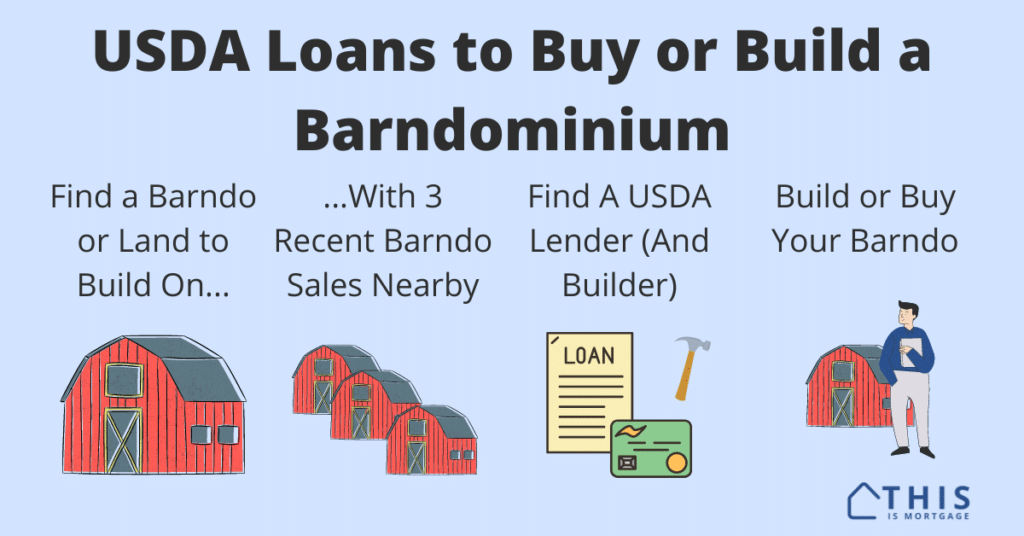

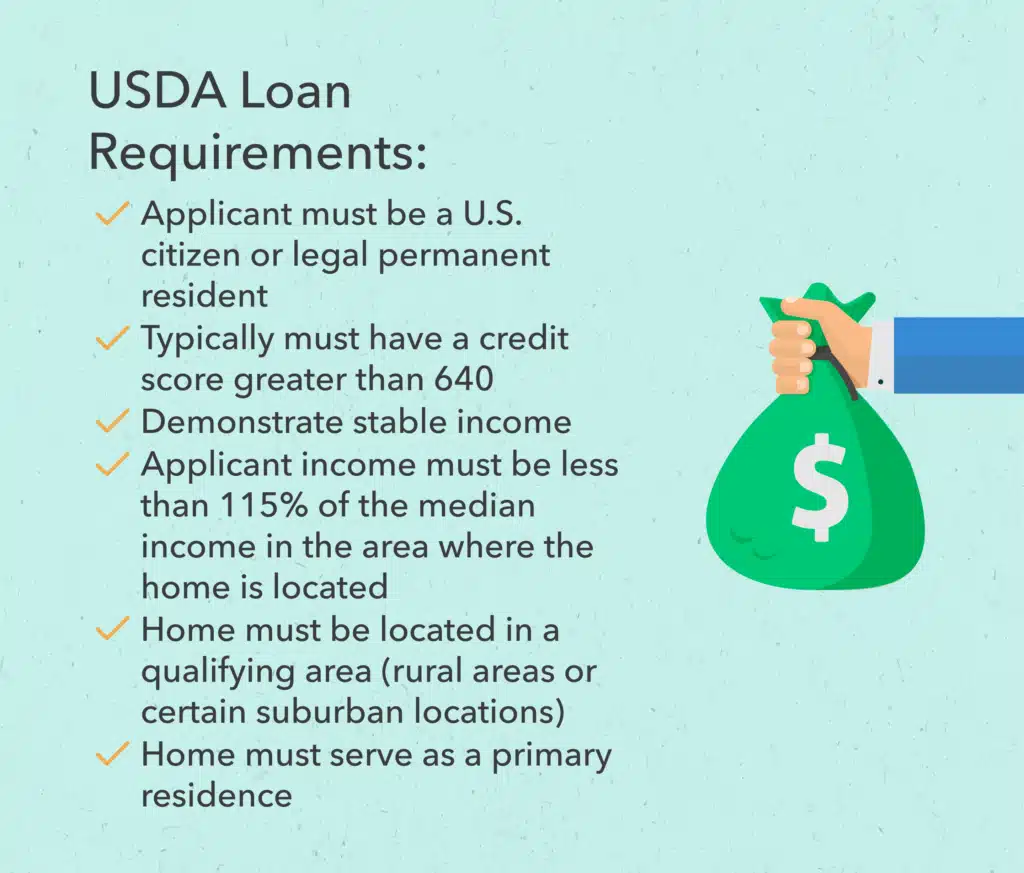

3. **USDA Loans**

In some rural areas, you may be able to use a **USDA loan** to finance your barndominium. These loans are offered by the U.S. Department of Agriculture and are designed to help people buy or build homes in rural areas. USDA loans often come with lower down payment requirements and favorable interest rates.

– **Eligibility**: To qualify for a USDA loan, the barndominium must be in a designated rural area, and the borrower must meet certain income limits. USDA loans are popular for barndominium financing because they are designed for non-traditional rural properties.

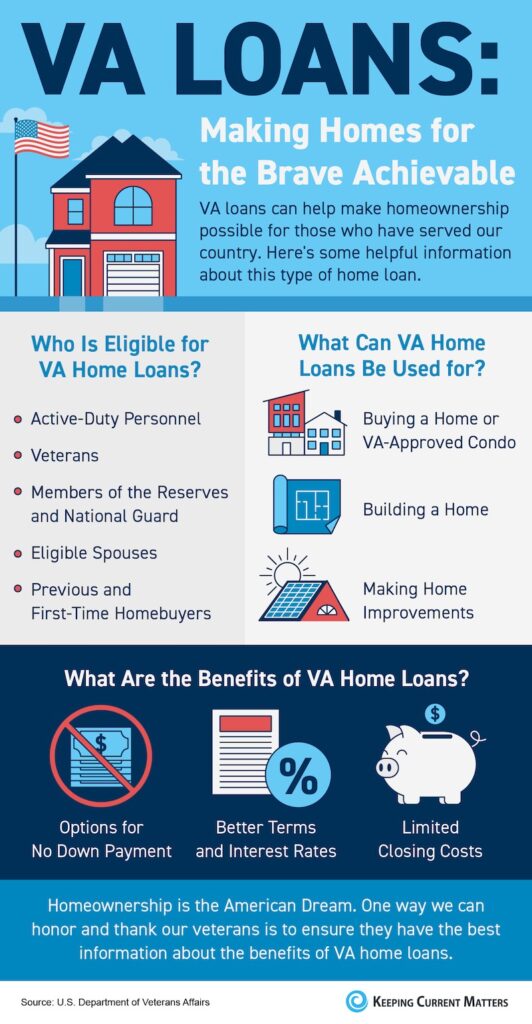

4. **VA Loans**

For eligible veterans, a **VA loan** may be a good option for financing a barndominium. VA loans are backed by the U.S. Department of Veterans Affairs and typically offer favorable terms, such as no down payment and low interest rates.

– **Eligibility**: VA loans can be used for both traditional homes and barndominiums, but you will need to ensure that the barndominium meets certain livability standards and is classified as a residence.

5. **Cash-Out Refinancing**

If you already own land or another property, you can use **cash-out refinancing** as a way to finance your barndominium. By refinancing an existing property, you can tap into the equity to fund your barndominium project.

– **How It Works**: Cash-out refinancing allows you to take out a new loan for more than what you owe on your current property, using the extra funds to finance the construction of your barndominium.

Tips for Securing Financing

To improve your chances of securing financing for a barndominium, follow these tips:

– **Work with Experienced Builders**: Choose a contractor or builder who has experience constructing barndominiums. Lenders may be more comfortable financing a project when they know it’s being managed by an experienced team.

– **Prepare a Detailed Plan**: Provide your lender with a thorough construction plan, including cost estimates, blueprints, and the contractor’s credentials. This helps alleviate lender concerns and shows that the project is well-organized.

– **Research Lenders**: Shop around for lenders who are familiar with barndominiums. Not all lenders have the same level of understanding when it comes to financing these types of homes, so finding one that specializes in them can make the process smoother.

Conclusion: Yes, You Can Finance a Barndominium

While financing a barndominium can come with a few more hurdles than financing a traditional home, it is certainly possible. With the right lender, a solid construction plan, and a clear understanding of the types of loans available, you can secure financing to build your dream barndominium. Whether through construction loans, USDA loans, or specialized barndominium lenders, there are multiple ways to finance your project, even if the path to approval might require a little more effort.