Financing Your Dream Barndominium: Navigating 30-Year Loan Options

The rise of barndominiums as a popular housing choice has sparked interest among potential homeowners looking for an alternative to traditional homes. These structures, known for their versatility, durability, and often cost-effective construction, blend the aesthetic of a barn with the comfort of a modern home. However, when it comes to financing a barndominium, many buyers wonder about their options, particularly the possibility of securing a 30-year loan. Let’s delve into the complexities and considerations surrounding 30-year loans for barndominiums.

Understanding Barndominium Financing

Understanding Barndominium Financing

Unlike traditional homes, barndominiums can present unique challenges for financing due to their unconventional nature. Lenders typically assess risk based on resale value and market demand, and non-traditional homes can be harder to appraise and sell. However, as barndominiums have become more mainstream, more lenders are recognizing their value and appeal, making financing more accessible than in the past.

Can You Get a 30-Year Loan on a Barndominium?

The short answer is yes, it is possible to secure a 30-year loan on a barndominium, but availability can vary significantly depending on several factors:

1. **FHA loans For Barndominium**

An FHA home loan can be a viable 30-year option for financing a barndominium, but whether it’s the best choice depends on various factors, including your financial situation, the specific characteristics of the barndominium, and FHA lending criteria. Here’s a detailed look at considering an FHA loan for a barndominium:

FHA Loan Benefits

**Lower Down Payment:** FHA loans require a down payment as low as 3.5%, making homeownership more accessible for individuals with limited savings.

**Flexible Credit Requirements:** FHA loans have more lenient credit requirements compared to conventional loans, potentially making them a good option for those with less-than-perfect credit scores.

**Fixed Interest Rates:** Opting for a 30-year fixed-rate FHA loan can provide stability with consistent monthly payments over the life of the loan, which is beneficial for long-term budgeting.

Considerations for Barndominium Financing

**Property Eligibility:** FHA loans have specific requirements regarding the property’s condition and eligibility. The barndominium must meet the FHA’s standards for safety, security, and structural soundness. This can be a hurdle if the barndominium is in a condition that does not meet these standards or if it’s considered too unconventional in design or construction.

**Primary Residence Requirement:** FHA loans are intended for primary residences only. This means you must plan to live in the barndominium as your main residence to qualify for an FHA loan.

**Appraisal and Inspection:** The FHA requires an appraisal and inspection to ensure the property meets its guidelines. For a barndominium, this process can be more complex, as the appraiser must be familiar with this type of property to accurately assess its value and ensure it meets FHA’s criteria.

**Mortgage Insurance:** FHA loans come with the requirement of paying mortgage insurance premiums (MIP), including an upfront premium at closing and an annual premium that’s typically added to your monthly mortgage payment. This can increase the overall cost of the loan over time.

Is An FHA Loan Right for Your Barndominium?

**Prospective Advantages:** If you have a smaller down payment saved up or if your credit history isn’t perfect, an FHA loan could provide the means to finance your barndominium as a primary residence. Its fixed-rate 30-year term can offer financial stability with predictable monthly payments.

**Potential Drawbacks:** The additional costs of mortgage insurance and the potential challenges of meeting FHA property standards for a barndominium are significant considerations. You’ll need to weigh these factors against the benefits of lower down payment and more lenient credit requirements.

An FHA home loan can be a good 30-year option for financing a barndominium, especially for borrowers who benefit from the program’s lower down payment requirements and more flexible credit criteria. However, the suitability of an FHA loan for your barndominium project will depend on your ability to meet the FHA’s property eligibility requirements, your financial readiness to handle the additional costs of mortgage insurance, and whether the barndominium will be your primary residence. As with any significant financial decision, consulting with a mortgage professional experienced in FHA loans and non-traditional properties like barndominiums can provide valuable guidance tailored to your specific situation.

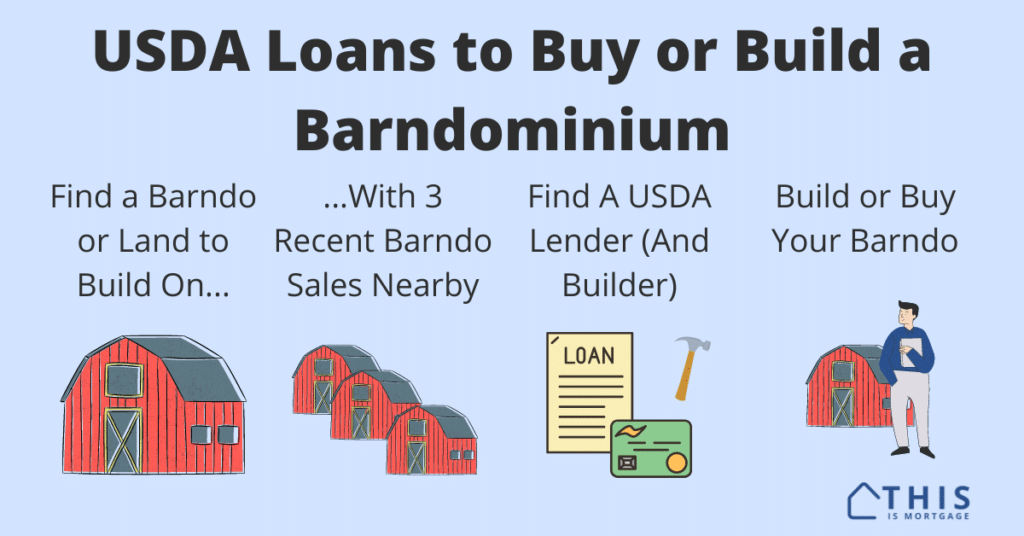

2. **USDA Home Loans for your Barndominium**

A USDA home loan, offered by the United States Department of Agriculture, is designed to assist low- to moderate-income individuals in purchasing homes in rural areas, offering several appealing benefits such as no down payment requirement and competitive interest rates. When considering a USDA loan for financing a barndominium, several key factors come into play to determine its suitability. Here’s an in-depth look at whether a USDA home loan is a good 30-year option for a barndominium:

USDA Loan Benefits

**No Down Payment:** One of the most significant advantages of a USDA loan is the ability to finance a home purchase without a down payment, which can make homeownership more accessible.

**Competitive Interest Rates:** USDA loans often come with interest rates that are competitive with, or even lower than, conventional mortgage rates, which can result in lower monthly payments.

**Fixed-Rate Mortgages:** Like FHA loans, USDA loans are available with 30-year fixed-rate terms, offering the stability of consistent monthly payments over the life of the loan.

Considerations for Barndominium Financing

**Geographical Eligibility:** USDA loans are restricted to properties located in eligible rural areas as defined by the USDA. While many barndominiums may naturally be situated in rural settings, it’s crucial to verify that the specific location of your project qualifies under USDA guidelines.

**Primary Residence Requirement:** The property financed with a USDA loan must be used as the borrower’s primary residence. If you plan to use your barndominium as your main home, this requirement aligns with your goals.

**Property Standards:** Similar to FHA loans, properties financed with USDA loans must meet certain health and safety standards. A barndominium will need to comply with these requirements, which could involve additional inspections and certifications depending on the construction and condition of the barndominium.

**Income Limits:** USDA loans are intended for individuals and families with low to moderate incomes, so there are income limits that vary by region. You’ll need to ensure your household income does not exceed the USDA’s eligibility criteria for your area.

**Loan Fees:** Although USDA loans do not require a down payment, they do include certain fees, such as an upfront guarantee fee and an annual fee, which is similar to mortgage insurance. These fees help fund the USDA loan program and are typically lower than the mortgage insurance premiums for FHA loans.

Is a USDA Loan Right for Your Barndominium?

**Pros:** The no down payment requirement and competitive interest rates make USDA loans an attractive option for eligible buyers looking to finance a barndominium in a rural area. The 30-year fixed-rate term offers long-term financial stability with predictable monthly payments.

**Cons:** The geographical and income restrictions, along with the property standards that must be met, can limit the feasibility of using a USDA loan for some barndominium projects. Additionally, the upfront and annual fees, while necessary for the loan’s funding, add to the overall cost of the loan.

A USDA home loan can be a good 30-year financing option for a barndominium, particularly for those looking to build or buy in rural areas and who meet the program’s income eligibility criteria. The benefits of no down payment and competitive rates are significant; however, potential borrowers must carefully consider the geographical and property eligibility requirements and the impact of loan fees on their overall financing costs. As with any mortgage decision, consulting with a lending professional who understands the USDA loan process and the unique aspects of financing a barndominium is crucial to navigating your options successfully.

3. **Construction Method and Materials**

Lenders will consider the construction method and materials of your barndominium when evaluating your loan application. Barndominiums built with steel frames and those that adhere to traditional residential construction standards are often viewed more favorably by lenders because they are durable and have a longer lifespan, which can make a 30-year loan more viable.

Tips for Securing a 30-Year Loan

**Research Specialized Lenders**

Look for lenders that specialize in rural properties, non-traditional homes, or construction loans. These institutions are often more knowledgeable about barndominiums and may offer more flexible financing options.

**Prepare a Detailed Proposal**

When approaching lenders, come prepared with detailed plans for your barndominium, including construction blueprints, a comprehensive budget, and information on the property’s intended use. Demonstrating thorough planning and a strong understanding of your project can help alleviate concerns lenders might have.

**Highlight Resale Value and Market Demand**

Provide evidence of the growing popularity and market demand for barndominiums in your area, including resale values of similar properties if available. Showing that your barndominium is a sound investment can make lenders more comfortable offering a 30-year loan.

**Consider Alternative Financing Options**

If traditional lenders are hesitant, explore alternative financing options such as credit unions, local banks, or lenders that offer USDA rural development loans. These institutions may offer more personalized lending criteria and be more willing to finance unique properties on a long-term basis.

While securing a 30-year loan for a barndominium is possible, it requires due diligence, preparation, and sometimes a bit of creativity in finding the right lender. As barndominiums continue to gain popularity, their acceptance in the financing world is also growing, making it easier for prospective homeowners to find long-term financing solutions. By demonstrating the viability, durability, and demand for barndominiums, you can increase your chances of securing a 30-year loan, turning your dream of owning a unique and personalized home into a reality.