Credit Score Requirements for Barndominiums

Barndominium kit homes are becoming an increasingly popular option for those looking for an affordable way to build a unique custom home with plenty of extra space. Most newer Barndominium kits opt for utilizing steel Framing instead of traditional lumber these days on account of the insane value offered by pre-fabricated & engineered Steel framing, not only are you getting rigid strength that crushes traditional wood frame homes but along with the strength and durability you’re getting the longevity that Steel provides over wood, the steel frame Barndominium kits are similar to those used for large barns and warehouses, but the interior is going to be outfitted as a residential home according to the custom Barndominium Floor Plans that you can find at Buildmax.com in many sizes and configurations, you can find Barndominium Floor plans of all kinds in abundance. Buying a barndominium kit allows you to customize the home’s layout and finishings while taking advantage of the cost-efficiencies of the pre-fabricated barn structure.

However, financing the purchase and or construction of a barndominium kit requires meeting certain credit score requirements to qualify for a loan. Understanding what credit scores different lenders look for can help you evaluate if you may need to take steps to improve your credit profile before applying.

FHA Loan

For borrowers looking for low down payments, Federal Housing Administration (FHA) loans are a popular option. FHA loans require just 3.5% down for qualified borrowers. However, you will need a minimum credit score of 580 to qualify for the most favorable terms. Applicants with scores between 500-579 may still be approved but will pay a higher interest rate. Those with FHA loans also have to pay mortgage insurance premiums. Barndominiums That are able to fully satisfy local building codes and zoning allowances can obtain FHA loans For Their Unique Barndominium Floor Plans & Barndominium kits built through an FHA loan program online or even locally.

Here are some of the best options to pursue FHA financing for a barndominium home:

Local Banks and Credit Unions

Connecting with small, community-based banks and credit unions is a great starting point for finding FHA loans. These localized lenders are more likely than big banks to understand the unique attributes of a barndominium home and consider that type of property for FHA programs. Smaller lending institutions have more flexibility in their approvals as well. Discussing FHA barndominium loans with loan officers at your local bank branches is recommended.

Online FHA Mortgage Lenders

National direct lenders that specialize in FHA loans, such as LoanDepot or CrossCountry Mortgage, can also be good sources. The benefit of such lenders is they offer set FHA products and programs that individual underwriters at banks may not be as familiar with. Online sites allow you to compare FHA interest rates and terms from multiple companies.

HUD-Approved Housing Counselors

For guidance on the FHA loan process for unique properties, non-profit HUD-approved housing counselors have the expertise to help borrowers. They can explain the requirements, and documentation needed, and qualify you for the maximum loan amount you’d be eligible for based on your specific financial numbers and barndominium details. Finding a housing counselor in your state is easy via HUD’s website.

Utilizing both local and national FHA mortgage options allows you to compare rates and services. Consulting unbiased housing counselors also aids the process of securing home financing approval. With multiple avenues to access FHA products, financing your dream barndominium can become affordable.

Conventional Loans

Conventional loans from banks and credit unions offer mortgage rates that are competitive with FHA loans, but they come with higher credit standards. Most conventional loans require a minimum 620 FICO credit score for approval. However, borrowers with scores of 720+ will get better interest rates. Putting down 20% for the down payment on a conventional loan also avoids the need to pay for private mortgage insurance.

Here are some banks and lenders that are known to provide conventional mortgage financing for barndominium projects:

Wells Fargo Home Mortgage

As one of the largest mortgage lenders in the U.S., Wells Fargo has extensive experience financing customized and unconventional homes, including barndominiums. They offer competitive rates and flexible loan programs and terms. Approvals are based in part on credit score, income, and loan-to-value ratios.

Local Banks and Credit Unions

Many small, local lending institutions such as community banks and credit unions are also comfortable financing barndominiums, especially in rural areas where these homes are more common. These lenders offer personalized services and willingness to evaluate each deal on its own merits. Credit standards still apply but may be a bit more flexible.

Quicken Loans

Quicken provides conventional mortgage financing nationally for qualifying borrowers building barndominiums. They have funded loans for customized barn homes across wide geographical areas. Quicken touts fast approvals and specialized loan officers familiar with the unique requirements involved.

Fidelity Bank Mortgage

Fidelity Bank offers mortgages for buyers looking to construct barndominium-style homes under their construction loan program. Terms allow for financing both the acquisition of the barndominium kit as well as costs associated with interior customization and finishing work.

In general, connecting with lenders that are more familiar and enthusiastic when it comes to Custom barndominium homes will most certainly increase your chances for approval with one of these lenders. Researching local options, along with national lenders open to non-traditional houses, will yield multiple possibilities for potential financing.

USDA and VA Loans

Two other specialized mortgage programs that can help certain borrowers get loans for barndominium projects with zero down payment are the USDA loan programs and the VA Loan programs both Federal Loan Programs. USDA rural housing loans and VA loans for veterans and military families require no money down. Credit standards for these programs range around 640 minimum FICO scores. Geographic and other eligibility requirements also apply for these government-supported loans.

Here are some tips on where to find USDA and VA loans for financing a barndominium home:

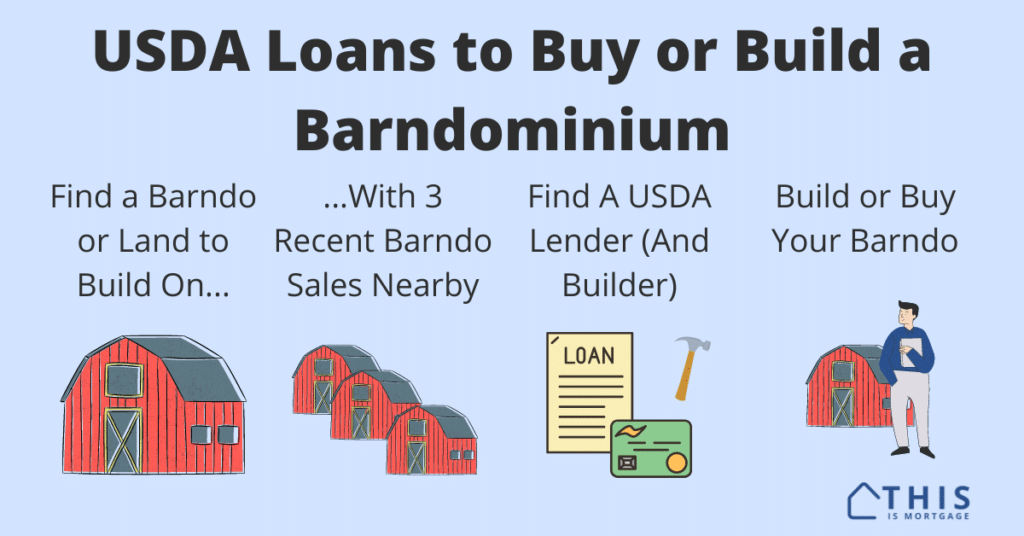

USDA Loans

The United States Department of Agriculture (USDA) Rural Development program offers zero-down payment loans for low-income borrowers in rural areas. To qualify for a USDA home loan, the property must be located in an eligible rural zone as defined by the USDA. You can check your address on their eligibility site. USDA loans can be obtained through approved lenders. Local banks and mortgage companies that participate in USDA lending are good options to pursue financing a barndominium with this program.

VA Loans

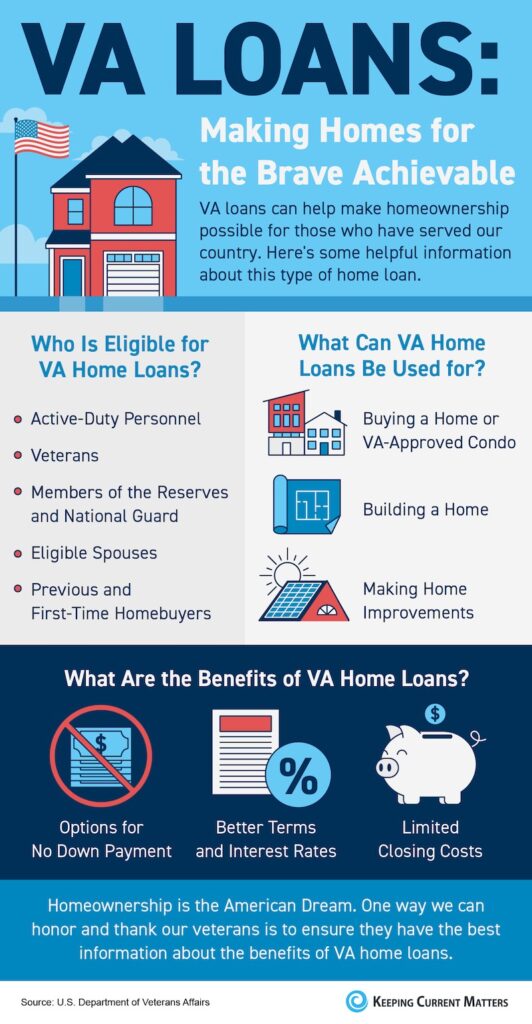

The U.S. Department of Veterans Affairs (VA) home loan program allows active duty military members, veterans, qualifying spouses, and National Guard members to receive 100% financing. There are no geographic restrictions on VA loans, but the borrower has to meet active/veteran status criteria. VA loans offer very competitive rates and require no down payment or monthly mortgage insurance payments. Military-friendly mortgage lenders that have experience with VA loans specifically for unique properties like barndominiums would be the best sources. Some places to check include Navy Federal Credit Union or Veterans United Home Loans.

For both USDA and VA barndominium loans, researching lenders in your local area that actively promote these government-backed lending programs will be key. The rural status eligibility for USDA loans limits options more narrowly geographically compared to VA loans. But both allow zero-down financing situations ideal for borrowers wanting to personalize their barndominium designs.

you can likely finance the purchase of a barndominium kit with engineered Floor Plans if you have at least a 580 credit score, but a 620+ FICO score is recommended to ensure you qualify for the most affordable financing rates. Improving your credit score if it’s currently below 580 may require paying down debts, correcting errors on your credit report, or responsibly managing new lines of credit. If your Loan gets Denied approval this isn’t the end, This just means more work is needed.

Here are some of the most effective methods to increase your credit score so you can get approval for a home loan:

1. Pay down credit card balances – Keeping credit card balances low compared to limits can significantly boost scores. Try to get balances below 30% of the card’s limit.

2. Dispute errors on your credit report – Errors on credit reports can drag down your scores. Dispute any inaccuracies you find through the credit reporting agencies.

3. Become an authorized user on someone else’s credit card – This can raise scores quickly if the primary cardholder has a positive payment history. Just make sure the card issuer reports authorized user history.

4. Don’t close unused cards – While closing unused cards may seem harmless, it can actually lower your overall available credit and increase credit utilization ratios.

5. Limit credit applications – Each application can cause a minor drop in scores temporarily. Apply selectively for only credit you need.

6. Pay all bills on time – Delinquent payments can devastate scores. Set up autopay or payment reminders to maintain good standing on all credit accounts.

7. Monitor your credit report – Stay aware of your current scores and any changes by checking your credit report frequently in the months preceding your home application.

Improving credit scores enough to meet specialized requirements on Loan approval for Barndominium kits and Floor Plans can take diligence across these different areas. Give yourself at least 6 months to implement positive changes that Banks and lenders will see as reducing the risk and then try again with your newfound confidence and knowledge.